Palantir Technologies in 2025: The Future of Defense and Business

Palantir Technologies has quietly evolved from a secretive government contractor into a major force shaping the future of enterprise data, artificial intelligence,…

Palantir Technologies has quietly evolved from a secretive government contractor into a major force shaping the future of enterprise data, artificial intelligence, and national security. Founded in 2003 with backing from the CIA’s venture arm In-Q-Tel, Palantir was long associated with classified military projects and intelligence analytics. But in 2025, the company has become much more than a defense supplier — it’s a public company with a growing commercial footprint, a bold AI strategy, and one of the most discussed (and debated) stocks in the business and finance world.

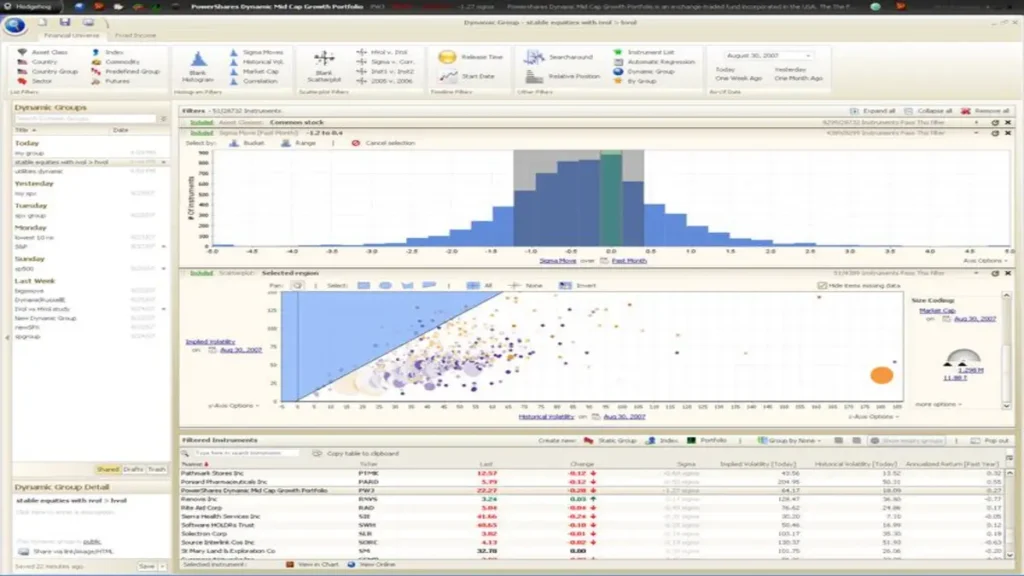

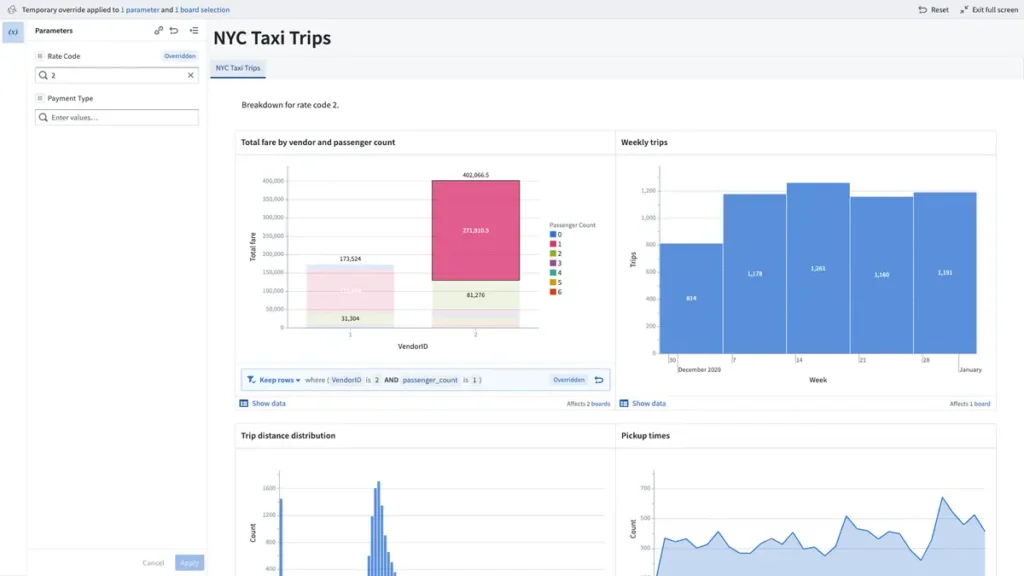

From its signature Gotham platform used by defense and law enforcement to its rapidly expanding Foundry solution for businesses, Palantir is betting that the ability to make sense of vast, complex data in real time will define the winners of tomorrow’s economy. Its early investments in AI and machine learning — especially its Artificial Intelligence Platform (AIP) — have positioned the company at the intersection of defense, logistics, healthcare, and advanced enterprise analytics.

In this article, we’ll explore where Palantir stands in 2025, how its financials are trending, and why its long-term vision continues to attract both investors and critics. Whether you’re tracking growth stocks or exploring how data is transforming business operations, Palantir offers a unique case study in ambition, innovation, and market disruption.

1. Palantir’s Evolution: From Defense to Enterprise Domination

Palantir Technologies started as a secretive data analytics firm focused almost exclusively on government and defense. In its early years, the company was known primarily for its work with U.S. intelligence agencies, providing tools to track terror networks, analyze battlefield data, and support national security operations through its Gotham platform. But fast forward to 2025, and Palantir has become a hybrid force—still deeply embedded in government, but increasingly dominant in the private sector.

The turning point came after Palantir’s 2020 IPO, when the company began shifting its narrative toward commercial applications. Under the leadership of co-founder and CEO Alex Karp, Palantir launched Foundry, a second platform designed for businesses, not just governments. Foundry enables organizations to ingest, process, and visualize complex datasets—allowing decision-makers to identify inefficiencies, optimize logistics, and anticipate future scenarios based on historical and real-time inputs.

This move opened the door to clients in healthcare, manufacturing, finance, and energy. In just a few years, Palantir has added clients like Airbus, Ferrari, Tyson Foods, and several large hospital networks. As of 2025, commercial revenue growth has outpaced that of its government sector—an intentional goal set by the company to reduce reliance on public contracts and increase recurring enterprise revenues.

What makes Palantir unique in the enterprise space is its full-stack, integrated approach to data. Unlike traditional SaaS firms that offer modular software, Palantir embeds teams into client organizations and customizes end-to-end solutions that sit atop a company’s existing systems. This model creates higher switching costs and long-term partnerships, rather than quick software licensing churn. In many ways, Palantir behaves less like a software vendor and more like a strategic partner.

The introduction of its Artificial Intelligence Platform (AIP) in 2023 accelerated this shift. AIP combines large language models with Palantir’s core infrastructure, allowing clients to interact with their data using natural language queries and AI-driven recommendations. In a time when businesses are racing to implement generative AI, Palantir’s offering stands out as secure, explainable, and fully integrated into operational workflows—critical for industries like defense, aviation, and finance where AI transparency and control matter.

Palantir’s pivot toward enterprise mirrors what many successful B2B companies have done: take deep expertise in one sector and scale it to solve broader, more profitable challenges. This approach aligns with larger business trends like business process automation, where data-driven decision-making and AI are reshaping how organizations operate.

With a growing commercial portfolio, global expansion, and first-mover advantage in operational AI, Palantir is no longer just a government contractor. It’s building the digital nervous systems of modern organizations—and redefining what a tech company can be in the age of AI and big data.

2. Palantir’s Financial Performance in 2025: Growth or Plateau?

As Palantir continues to grow its presence in both the public and private sectors, its financial health in 2025 is under a spotlight. For a company that commands billions in market capitalization and has ambitions to redefine enterprise AI, investors want more than vision—they want results.

In Q1 2025, Palantir reported strong double-digit revenue growth, driven by a surge in commercial contracts. According to Yahoo Finance, the company generated approximately $640 million in quarterly revenue, a year-over-year increase of 22 percent. Notably, commercial revenue made up more than 55 percent of total revenue—marking a significant shift from its earlier government-heavy client mix.

Gross margins remain healthy, hovering above 78 percent, which is standard for software companies but impressive for a firm that blends software with hands-on implementation. The company’s free cash flow has improved, and it has sustained a positive adjusted EBITDA for multiple quarters, contributing to its status as one of the more financially stable players in the high-growth AI sector.

Palantir has also reiterated full-year revenue guidance between $2.6 billion and $2.7 billion, bolstered by key commercial wins and the expansion of its Artificial Intelligence Platform (AIP). One of the standout deals this year was with a leading European automotive firm seeking to streamline supply chain operations using predictive analytics and AI modeling—a clear validation of Palantir’s enterprise vision.

Still, there are concerns. Despite improving fundamentals, some analysts argue that Palantir’s valuation remains stretched. The stock trades at a forward price-to-sales ratio significantly higher than peers like Snowflake or Datadog. Critics point out that sales growth has slowed slightly compared to its breakneck pace in 2021–2023, raising questions about how long the AI hype can sustain such high expectations.

Others worry about Palantir’s reliance on stock-based compensation. The company has made progress reducing dilution, but it continues to issue equity to attract and retain top technical talent—a common issue among tech firms, but one that can impact long-term shareholder value.

Palantir’s bullish case hinges on three pillars: sustained commercial adoption, government contract renewals, and full-scale deployment of AIP. If all three continue to accelerate, the company could move closer to GAAP profitability and justify its premium. But if AI spending slows or competitors catch up, its momentum could flatten.

According to analysts at The Motley Fool, Palantir is at a critical juncture—balancing between visionary AI potential and the market’s demand for more predictable, scalable financial performance. The next few quarters will determine whether Palantir breaks through its current revenue ceiling or settles into slower, more cautious growth.

3. AI as a Competitive Moat: Why Palantir’s Strategy Matters

Artificial intelligence is no longer just a buzzword — it’s a foundational technology reshaping entire industries. But while many companies are rushing to plug AI into their products, Palantir has taken a very different path: it has built its business model around AI from the ground up. This deliberate, infrastructure-first approach is what may give Palantir a long-term edge as AI adoption matures across the private and public sectors.

Palantir’s Artificial Intelligence Platform (AIP) is at the heart of its strategy. Launched in 2023 and expanded aggressively in 2024, AIP allows organizations to harness large language models, machine learning, and predictive analytics within secure and highly customizable environments. Unlike more general-purpose AI tools, AIP is built to handle sensitive data, regulatory compliance, and real-world operational needs — making it especially valuable in sectors like defense, manufacturing, and finance.

What sets Palantir apart is its focus on AI implementation at scale. While competitors often offer plug-and-play solutions, Palantir embeds engineers and product teams with its clients, guiding them through deployment and tailoring AIP to each organization’s specific workflows. This hands-on integration makes its AI offerings harder to replicate and more deeply embedded in client systems — a powerful competitive moat.

Another major differentiator is Palantir’s emphasis on explainability and control. As generative AI models become more powerful but also more opaque, many enterprises are concerned about trusting decisions made by black-box algorithms. Palantir addresses this by offering full transparency, auditability, and human-in-the-loop controls — all of which are essential for regulated industries.

As more companies begin integrating AI into their core processes, those that do so responsibly and strategically will have a major advantage. Palantir is positioning itself not just as an AI vendor, but as a partner that helps organizations become AI-native — meaning they use artificial intelligence not as a supplement, but as a central driver of operations and innovation.

This strategy mirrors trends seen in broader enterprise transformations. Companies that embrace automation, intelligent systems, and data-driven culture tend to outperform those that react slowly. If you’re interested in how similar principles are shaping other areas of business, check out our feature on The Money Secret Behind Business Process Transformation — a look at how modern tools are fueling growth and reducing inefficiencies across industries.

Palantir’s long-term bet is that AI will become not just useful, but indispensable — and that organizations will need a trusted infrastructure to run it responsibly. If they’re right, and early adoption pays off, Palantir’s early investment and operational-first mindset could make it one of the defining enterprise tech companies of the next decade.

4. Risks, Criticisms, and What Could Go Wrong?

While Palantir Technologies has positioned itself as a visionary force in the enterprise AI and government analytics space, the company is far from immune to risk. In fact, some of its boldest strengths are also the very traits that critics point to when raising red flags. From valuation concerns to cultural critiques, Palantir’s rise hasn’t been without turbulence — and investors would be wise to consider these risks in the broader narrative.

1. High Valuation in a Competitive Market

Perhaps the most consistent concern from Wall Street analysts is Palantir’s lofty valuation. Even as the company has improved its financials, it continues to trade at a premium compared to other software companies with similar growth rates. In 2025, Palantir’s forward price-to-sales ratio remains significantly higher than industry averages — and that leaves little room for error.

If AI spending softens or if the company experiences slower commercial client acquisition, the stock could see sharp corrections. It’s not uncommon for tech investors to rotate out of high-multiple stocks quickly when confidence falters, especially in a rising interest rate environment.

2. Dependence on Government Contracts

Despite expanding its commercial portfolio, Palantir still depends heavily on government contracts — especially U.S. defense and intelligence agencies. In Q1 2025, public sector revenue accounted for just under half of total earnings. While this provides long-term stability, it also subjects the company to political cycles, regulatory scrutiny, and shifting national budgets.

Changes in leadership, government procurement delays, or public backlash against surveillance-related technologies could impact Palantir’s ability to renew or expand contracts. In countries outside the U.S., geopolitical tensions may also limit growth opportunities.

3. Transparency and Culture Concerns

Palantir’s internal culture — often described as secretive, intense, and highly opinionated — has sparked both admiration and criticism. CEO Alex Karp is known for his philosophical stance on tech ethics and an often polarizing communication style. While this approach has helped to maintain a unique identity, some critics argue that the company lacks the transparency and investor engagement typical of public companies.

Its past reluctance to engage with mainstream media, limited quarterly guidance, and preference for direct government relationships over broader enterprise marketing can raise eyebrows for traditional investors.

4. Stock-Based Compensation and Shareholder Dilution

One of the most cited shareholder concerns has been Palantir’s extensive use of stock-based compensation. While the company has taken steps to reduce dilution in recent quarters, many long-term holders remain wary. High employee compensation through equity can weigh on earnings per share and cause discontent among retail investors who feel the stock price remains suppressed by dilution.

Final Thought on Risk

Palantir is a company with bold ambitions and unconventional methods. That makes it exciting, but also unpredictable. The biggest risks lie in whether it can maintain its unique identity while scaling sustainably. Its ability to deliver predictable commercial growth — while keeping public confidence and investor trust — will determine whether Palantir becomes a long-term enterprise staple or just another overhyped tech story.

5. Market Outlook: Is Palantir the Next Big AI Stock?

As artificial intelligence becomes more central to global business strategy, the market is actively searching for companies that can serve as the foundational layer for AI deployment across industries. For many retail and institutional investors, the big question is: Can Palantir become to enterprise AI what Nvidia is to AI hardware?

Palantir’s strategy places it in a unique position. Unlike traditional SaaS companies that build narrowly focused tools, Palantir aims to be the operating system for data-driven decision-making. Its clients include governments, healthcare systems, car manufacturers, and financial institutions — all of which are now racing to integrate AI in high-stakes environments.

This has drawn comparisons to AWS in the early 2010s — a behind-the-scenes infrastructure layer that powers critical operations, but isn’t always in the spotlight. If continues expanding its AI offerings with security, scalability, and speed at the forefront, it could claim a similar role in the software layer of AI.

Analysts also point out that Palantir’s long sales cycles and deep integrations create high client retention, which is key for long-term revenue stability. Once deployed, its platforms become so embedded in client operations that replacing them becomes expensive and disruptive — a trait investors value in tech infrastructure providers.

On the downside, competition is heating up. Giants like Microsoft, Google Cloud, and Snowflake are all developing robust enterprise AI capabilities. While Palantir has a head start in defense and critical operations, it must continue to innovate aggressively to fend off better-funded rivals.

Still, 2025 may be the year that defines Palantir’s future. If the company can demonstrate consistent commercial growth, expand its AI platform’s footprint, and deliver on profitability goals, investor sentiment could shift decisively. With global demand for operational AI rising fast, Palantir’s core competencies are finally aligning with one of the decade’s biggest technology trends.

In the eyes of bullish investors, this makes Palantir not just a government contractor or software firm — but potentially one of the defining AI stocks of the 2020s.

Palantir Technologies stands at a fascinating crossroads in 2025 — one where vision, technology, and financial performance are finally beginning to align. Once viewed as a shadowy defense contractor with a niche clientele, Palantir has steadily repositioned itself as a major player in enterprise AI and data infrastructure. Its ability to navigate both the public and private sectors gives it a unique resilience in an increasingly competitive tech landscape.

With its Artificial Intelligence Platform (AIP), deep client integrations, and commitment to responsible AI deployment, Palantir is not merely riding the AI wave — it is helping shape the very frameworks through which AI is deployed and understood. Its financials are trending upward, its commercial footprint is growing, and its strategic partnerships continue to deepen.

Yet, the company’s road ahead is not without risk. High valuation, reliance on long government sales cycles, and cultural transparency concerns still linger. To justify its premium, Palantir must continue demonstrating not just innovation, but repeatable, scalable growth in the commercial sector. The next two to three years will be pivotal.

For long-term investors who believe in the rise of operational AI — and in the need for secure, enterprise-grade platforms to manage it — Palantir offers both a compelling story and a potentially transformative opportunity. Whether it becomes a staple of the modern enterprise tech stack or a cautionary tale of ambition unmet will depend not just on product, but on execution.

In an era where data is power and AI is infrastructure, Palantir’s future may be as significant as the technologies it helps unlock.